FairMoney: 7 Things You Should Know About FairMoney MicroFinance Bank Before Borrowing

The digital banking industry in Africa is now being revolutionized by FairMoney Microfinance Bank, a major fintech business.

The Nigerian firm known for its microlending dominance has evolved into a full-fledged credit-led digital bank. With this unprecedented height comes the promise of providing fair banking to everyone. FairMoney prides itself on being a financial 'leveller,' ensuring that everyone has equal access to possibilities.

Video: Fair Banking for All - FairMoney Microfinance Bank

FairMoney is all about Fair Banking For All, and as Laurin Hainy, CEO/Co-founder of FairMoney, puts it, "Fair Banking For All is not just a mantra but a promise to ensure that everyone, regardless of social standing, has access to the best banking service there is, which is why we have made FairMoney Microfinance Bank your reliable banking partner providing solutions to help you take advantage of all of life's opportunities."

|

| FairMoney: 7 Things You Should Know About FairMoney MicroFinance Bank Before Borrowing |

Below are the 7 Things You Should Know About FairMoney MicroFinance Bank Before Borrowing

1. FairMoney MFB is a digital bank that focuses on credit: People still overlook it, even how plain it has become. FairMoney is one of the few Nigerian Fintechs that has transitioned from microlending to a full-fledged credit-driven digital bank.

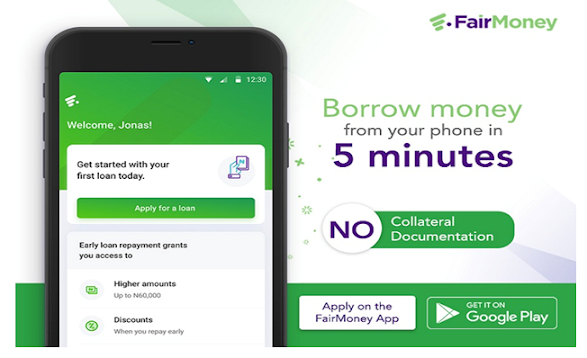

2. You can get a loan in as little as 5 minutes! With loan top-ups and loan extension services, you have even more loan flexibility. Let's move on now, as I'm sure you already know this.

3. When you establish an account with FairMoney MFB, you will receive a free secure debit card. It doesn't stop there; the card is delivered to you for free, wherever you are. Isn't it amazing?

4. On airtime, data purchases, and other bill payments, you enjoy a 3% discount. You will not only receive seamless services when paying your utility bills, but you will also receive a discount. This isn't available anyplace else.

5. Every month, you'll receive 100 free bank transfers. This is just incredible; image making up to 100 transactions, all for free; you simply had to adore FairMoney.

6. On your first 15-day loan, you will be charged 0% interest. This basically means that if you are a new user and take a 15-day loan for the first time and pay it back in 15 days, you will not be charged any interest.

7. You may earn up to 21% on your investments. You probably didn't realize that FairMoney assists you in investing your money; well, they do, but the catch is that fixed deposits provide the best interest rates.

FairMoney: Click Here to Download - Install - Apply

What does Fair Banking for all mean? It means ANYONE should have access to Fair treatment from their bank; no service offering should be beyond reach or reserved for “VIP”.

0 Comments